Investcorp: Introducing Wealth to a New Generation of Investors

Overview

This project embarks on a journey to revolutionize the world of investment, introducing Investcorp to the Millennial and Gen Z audience. In this case study we discover how we're embracing digital transformation to create a seamless, user-friendly investment experience that caters to the audience’s wants and needs while upholding Investcorp’s legacy of trust and excellence.

Objectives

This case study aims to provide readers with:

A comprehensive understanding of the challenges, methodologies, and solutions involved in enhancing the user experience for Investcorp's Wealth Mobile Application.

Insights into the user-centric design process, its research and outcomes, the impact of usability and A/B testing results, and the operations that underwent successful user experience transformation.

Challenge

Investcorp has set its sights on harnessing the potential of its digital platforms to further connect with the younger generations. And want to create a seamless and engaging digital experience that captivates Millennials and Gen Zs in the world of investments.

Content

As we set out on our presentation journey, let's chart a course through its content and highlights and explore the core keynote areas:

Disclaimer

The content and materials presented in this project do not represent the views, opinions, or official endorsement of Investcorp or any affiliated entities. This project is a part of the educational curriculum of the User Experience Design Immersive course offered by General Assembly. The use of Investcorp's logo and copyrighted materials within this project is for educational and demonstrative purposes and is authorized by General Assembly. All rights to the original content, materials, and logos are owned by their respective copyright holders.

This project is intended for educational and illustrative purposes only and should not be considered an official statement or representation of Investcorp or its affiliates.

Investcorp is a leading global manager of alternative investments that was founded in 1982. Its history is rooted in a strong service ethos that nurtures client relationships worldwide.

Their commitment to responsible and profitable investment strategies and consistency in delivering robust performance over four decades has earned them the trust of investors across the globe. Today, they are operating in Tokyo, Beijing, Singapore, Delhi, Mumbai, Abu Dhabi, Doha, Manama, Riyadh, London, New York, and Los Angeles.

Investcorp has distinguished itself through its core principles of reliability, transparency, judgment, innovation, and a relentless focus on generating superior results. As of June 30, 2022, Investcorp manages over $50 Billion worth of assets diversified across three continents, six asset classes, and numerous product lines.

COMPANY OVERVIEW

01

Asset Classes*

$ 1.0 B

Infrastructure

$ 7.4 B

Absolute Returns

Diversity

Equity

Inclusion

$ 1.0 B

$ 6.6 B

Private Equity

Strategic Capital

$ 16.1 B

$ 9.9 B

Real Estate

Credit Management

*Total Assets Under Management (AUM) as of December 2022

DEI Pillars and Values

The aim of DEI is to foster and nurture a learning and working environment in a world of constant change. Investcorp has committed itself to promoting a more inclusive environment for all people and believes that diversity leads to better outcomes for everyone, including their investors, investment partners, and employees.

Along the way, Investcorp has increased its memberships and affiliations to include organizations that support and enhance their DEI Journey.

Digital Offerings

Investcorp has consistently evolved to cater to its diverse client base by embracing cutting-edge technology and innovation.

One of the key milestones in this journey has been the development of a web portal and mobile applications. These digital platforms have become instrumental in providing clients with access to investment opportunities and real-time market insights.

By harnessing the power of digital technology, Investcorp has not only expanded its reach but has also reinforced its commitment to delivering tailored investment solutions to clients across the globe.

This strategic move reflects Investcorp's acknowledgment of the need to adapt in order to attract younger generations, Millennials and Gen Zs in particular, and to extend this commitment to their values for every investor regardless of age, as they strive to create a more inclusive and accessible investment landscape.

02

Target Audience

Millennials & Gen Zs

Often referred to as the younger digital-savvy generations, Millennials and Gen Z Generations are now the primary focus of Investcorp's efforts to engage with to further diversify their investor base.

Common Characteristics

Both generations exhibit distinct characteristics that significantly influence their consumer behavior, rendering them a formidable demographic force. They are commonly referred to as:

Digital Natives

Raised in the digital era, both Millennials and Gen Z have seamlessly integrated digital devices, social media, and online platforms into their daily lives for communication, entertainment, and work.

Advocates of Diversity and Inclusivity

These generations actively champion social justice, equality, and representation, both within the workplace and society as a whole. They hold organizations and brands accountable for reflecting and promoting these values.

Purpose-Driven

Millennials and Gen Z often seek greater purpose and significance in their career and life choices. They are drawn to organizations that demonstrate a strong commitment to social and environmental causes, prioritizing experiences and products that align with their personal values and principles

03

Research Phase

Competitive Analysis

The initial step in our research involved conducting a comprehensive plus/delta analysis of Investcorp's wealth app against its competitors in Bahrain:

This Competitive Analysis was aimed to assess commonalities and differentiators of Investcorp’s Wealth platform among some of the key players in the financial industry of Bahrain:

Bank of Bahrain and Kuwait

National Bank of Bahrain

Bahrain Islamic Bank.

This analysis provided us with valuable insights into market trends, features and functionalities, user preferences, and areas of opportunity.

Pluses

Robust User Onboarding Process,

Up-to-date Investment Portfolio Status,

Ability to view investment opportunities, and

Strong Provision of News, Documents, and Monthly Reports.

Deltas

Insufficient Investment Opportunity Information,

Undisclosed Information about Investcorp’s Brand Identity, and

No provided links to Investcorp’s Social Media Channels (Twitter/X, Youtube, etc.)

User Interviews

Gain insight into the challenges that seasoned investors face and the barriers that non-investors encounter when considering entry into the investment market.

Objective:

Total Interviews:

Participants Types:

7 Interviews

Experienced/Non-Investors

Total Questions:

19 in Total

In-Depth Site Mapping

This activity enabled us to completely comprehend Investcorp Wealth App content and offerings, and how it is organized and structured, allowing us to fully capture user flows, investing journey, and constructing a detailed heuristic evaluation of the application.

Problem Statement

In summary of our findings, we’ve concluded that the key issue is as follows:

Users belonging to the Millennial and Gen-Z Generations need to be well-informed about investing and encouraged to seize investment opportunities because they lack sufficient knowledge about the domain and feel overwhelmed by the options to make sound financial decisions.

So, How might we develop an engaging and informative platform that empowers Millennials and Gen-Z to build their investment knowledge, fosters trust in Investcorp, and encourages them to take proactive control of their financial future?

Solution Statement

In response to the identified challenges, our solution centers on creating a user-centric mobile app that:

Offers educational and informative material on investment.

Helps the users learn more about investment opportunities.

Updates users with the latest news and trends in the financial landscape.

Forges trust with Investcorp’s provided services and personnel.

Enables users to make sound financial decisions and confidently take control of their financial future.

We will consider ourselves successful when we see an increase in the number of Mobile App downloads and interactions, an increase in the number of Millennial and Gen-Z clients, and an increase in the number of investors.

04

Crafting Solutions

Personas

These personas represent real users, each with unique backgrounds, needs, and aspirations, offering valuable insights into how Investcorp can better serve a broad spectrum of investors:

Nadia O’Conner

Inspired Investor

Age: 23 years old

Gender: Female

Location: Dublin, Ireland

Background

Nadia is a fresh Civil Engineering graduate, she is passionate about sustainable architecture and dreams of contributing to a greener future. Her passion extends to her investment choices. However, she finds it challenging to access educational resources on investing from established investment firms, as she seeks not only financial growth but also to support companies that prioritize environmental and sustainability initiatives.

Needs

Guidance, Education, and Mentorship,

Transparency and Integrity from the investment company, and

User-Friendly tools that cater to beginners.

Pain Points

Overwhelmed by the complexity of the investment jargon,

Lack of understanding about how and where to start investing, and

Fear of losing money due to limited knowledge and experience.

Rashid Al Mansoori

Conservative Investor

Age: 36 years old

Gender: Male

Location: Abu Dhabi, UAE

Background

Rashid is an experienced investor who is very cautious about where he places his money due to previous investment setbacks. He values transparency and seeks to diversify his portfolio with a company that can offer him clear and easy-to-understand investment opportunity information and help him avoid future setbacks. Rashid believes that informed decisions are crucial to securing his family's financial future and achieving his long-term financial goals

Needs

Informed Decision-Making,

Diversification Options, and

Sense of Community and Engagement with the company.

Pain Points

Difficulty in finding reliable, up-to-date market data.

Lack of guidance on how to create investment plans.

A desire for shared knowledge from the company he wants to invest with.

User Flows

The following user flows have been designed to capture the key pathways and interactions that would form the ideal user journey for both seasoned investors and newcomers:

Features & Comparative Analysis

In our pursuit of enhancing user engagement through the introduction of educational and informative materials, we conducted a Comparative Analysis aimed at exploring trending features and functionalities implemented by the educational industry leaders and identifying best practices prevalent in today's market:

LinkedIn Learning

Udemy

General Assembly ( myGA )

Feature Cards

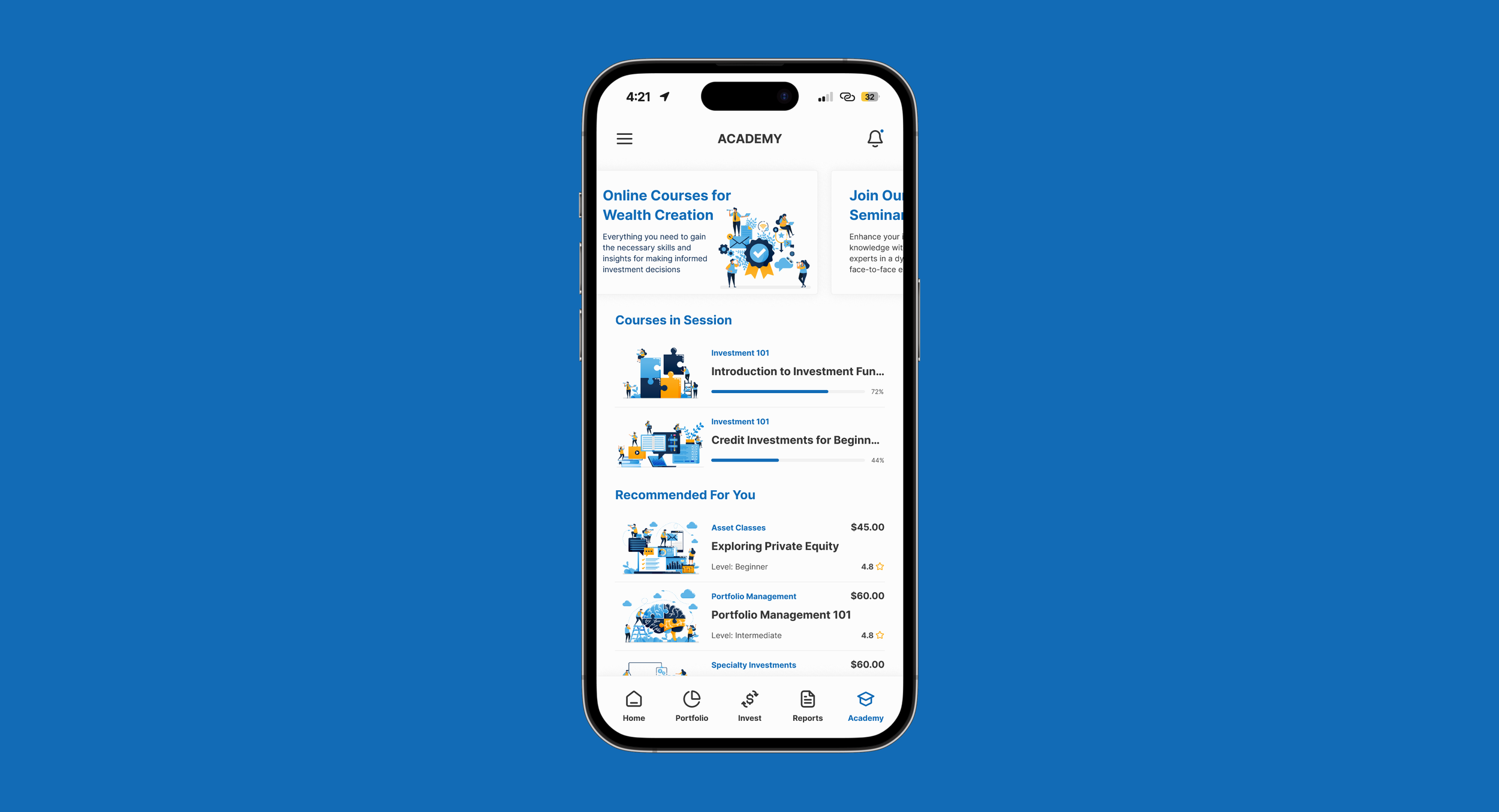

Site Re-Structuring

The introduction of a dedicated educational resources section and the incorporation of various user-engagement features necessitated a restructuring of the application, resulting in the following layout:

05

Design Phase

Low-Fidelity Sketching

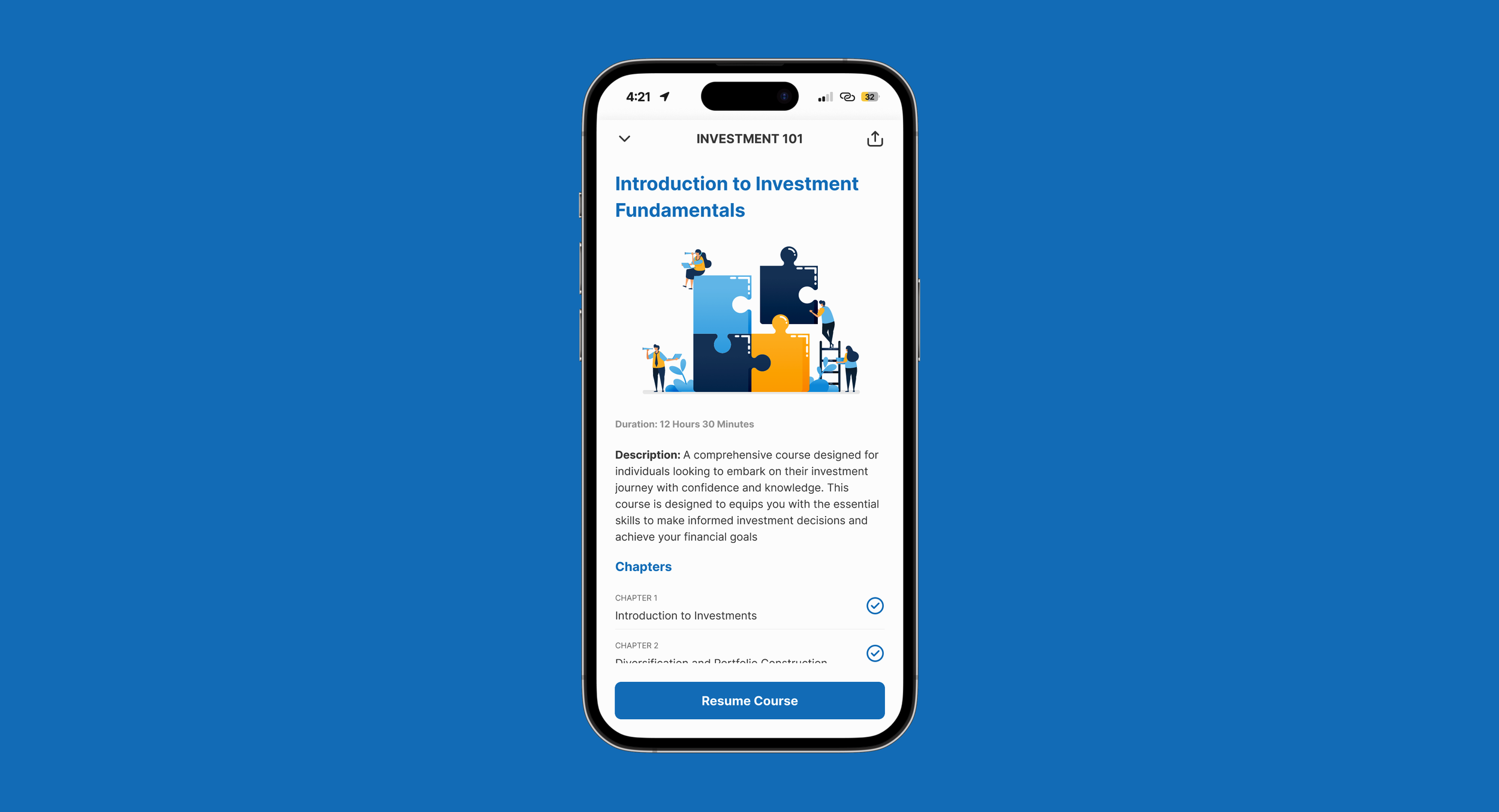

We initiated the prototyping process by creating sketches that were derived from the existing layout of Investcorp's Wealth app. This exercise allowed us to seamlessly integrate news and engagement features into the home screen while also designing the layout for the educational resources section.

Home Screen

Academy Home

News

Course Outline

Tweets/Threads

Unit Video and Script

Videos

Recap

Podcast

Live

Knowledge Check / Question

Knowledge Check / Answer

Mid-Fidelity Sketching

Through intensive sketching and ideation sessions, we laid the foundation for the app's structure and functionality, we crafted an interactive prototype simulating user flows with precision, that was poised for usability testing.

Usability Testing

Our usability testing aimed to ensure the effectiveness and user-friendliness of the prototype, we engaged 5 participants with the focus on completing the two aforementioned user flows:

Engaging with an interactive learning experience, and

Seizing an investment opportunity.

The results of this testing were highly promising, with each participant successfully navigating and completing the designated tasks. Key highlights from the usability testing include:

100% successful completion of the two user flows.

Participants consistently praised the app's intuitive design and navigation.

Feedback highlighted a few ambiguous titles and labels and suggested some iterations to increase the clarity of the design.

A/B Testing

This type of test played a pivotal role in fine-tuning our prototype to meet user preferences and expectations. We evaluated two variations of the learning experience (inspired by comparator apps) in order to identify which functionality resonated more with users.

The results of our A/B testing provided valuable insights, with a substantial 80% of participants favoring the functionality offered by Version B.

Based on this feedback, we have incorporated the favored features into the final design, ensuring that our app aligns with the preferences of the majority of our target users.

06

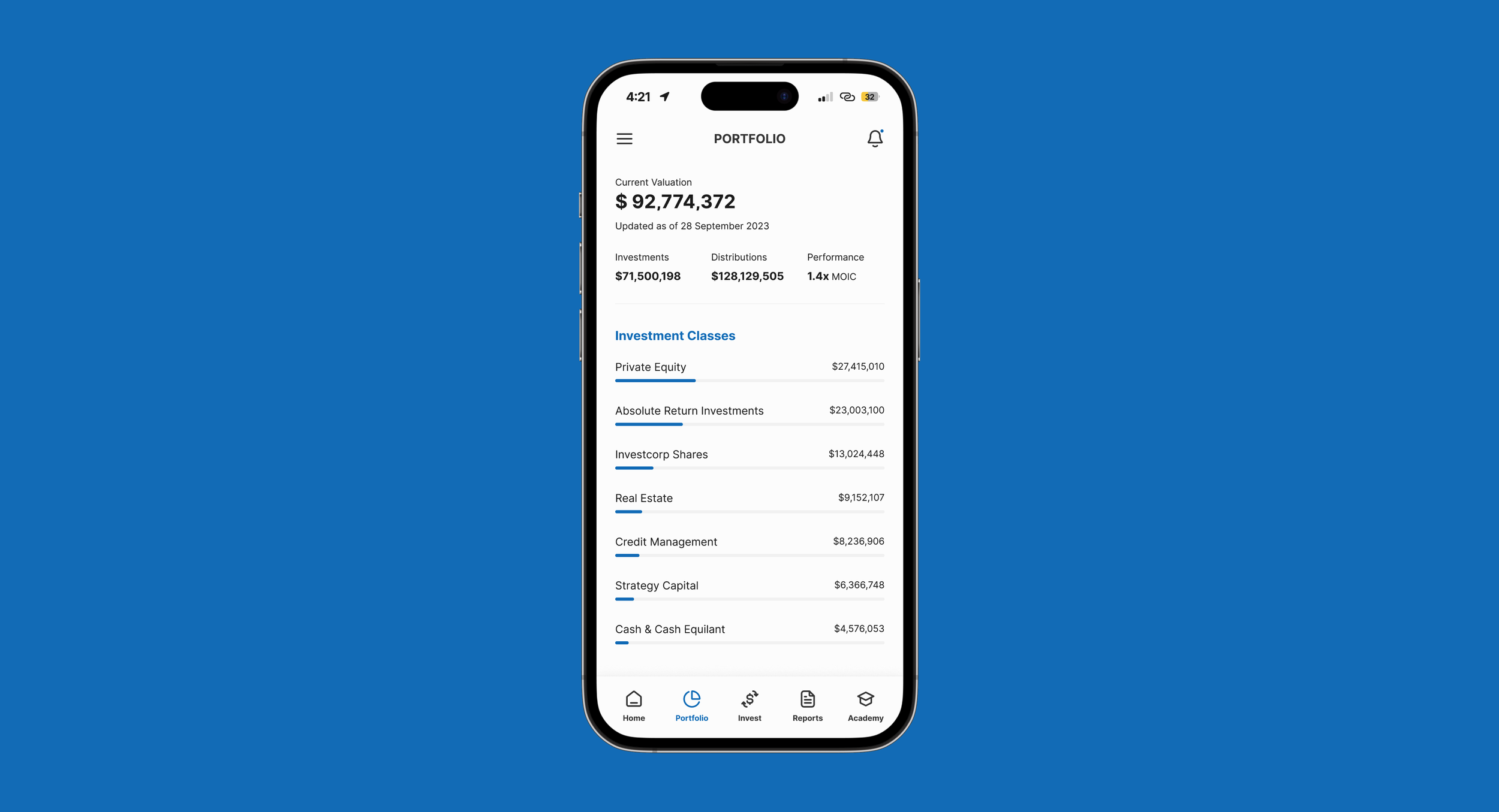

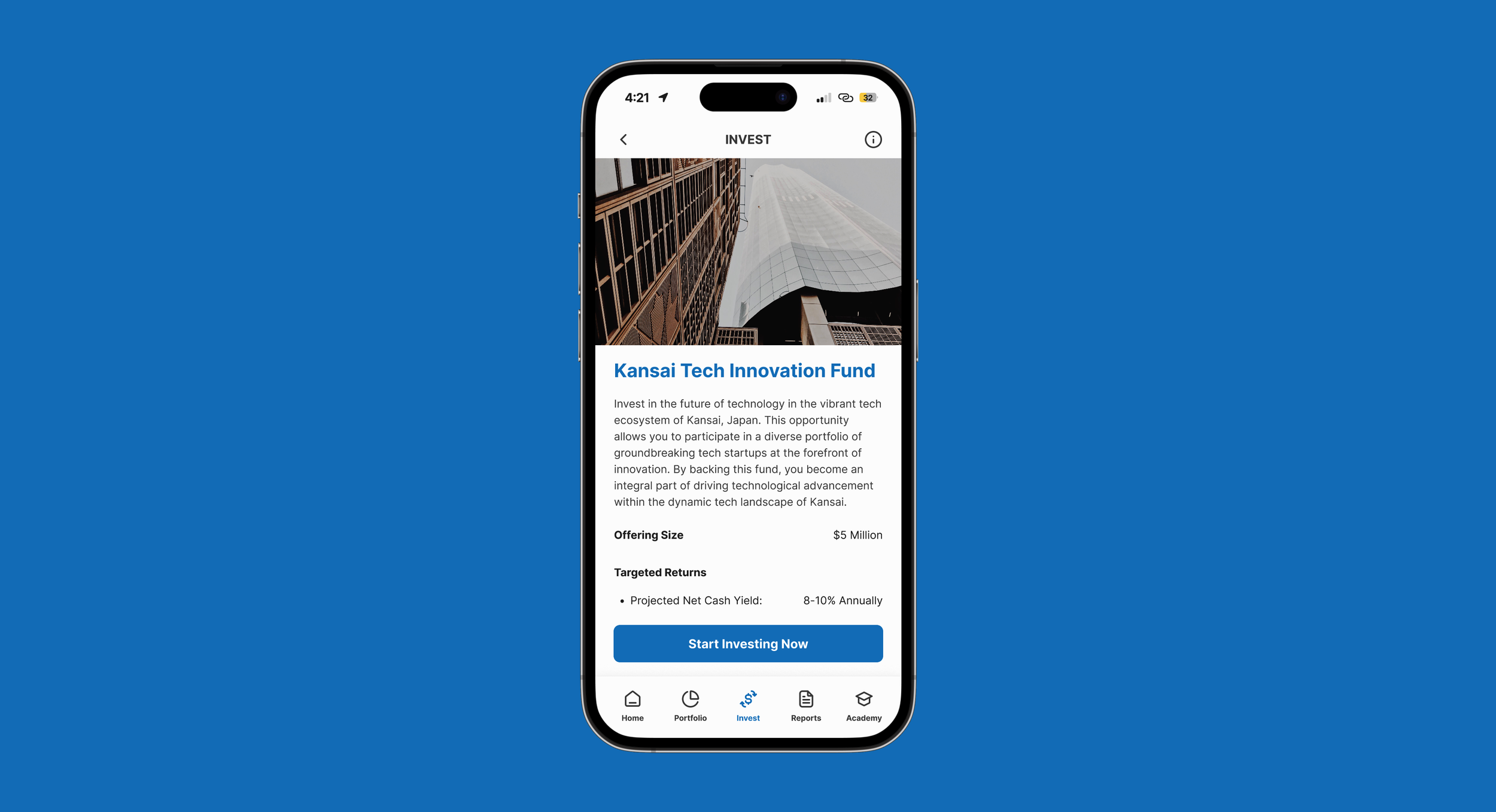

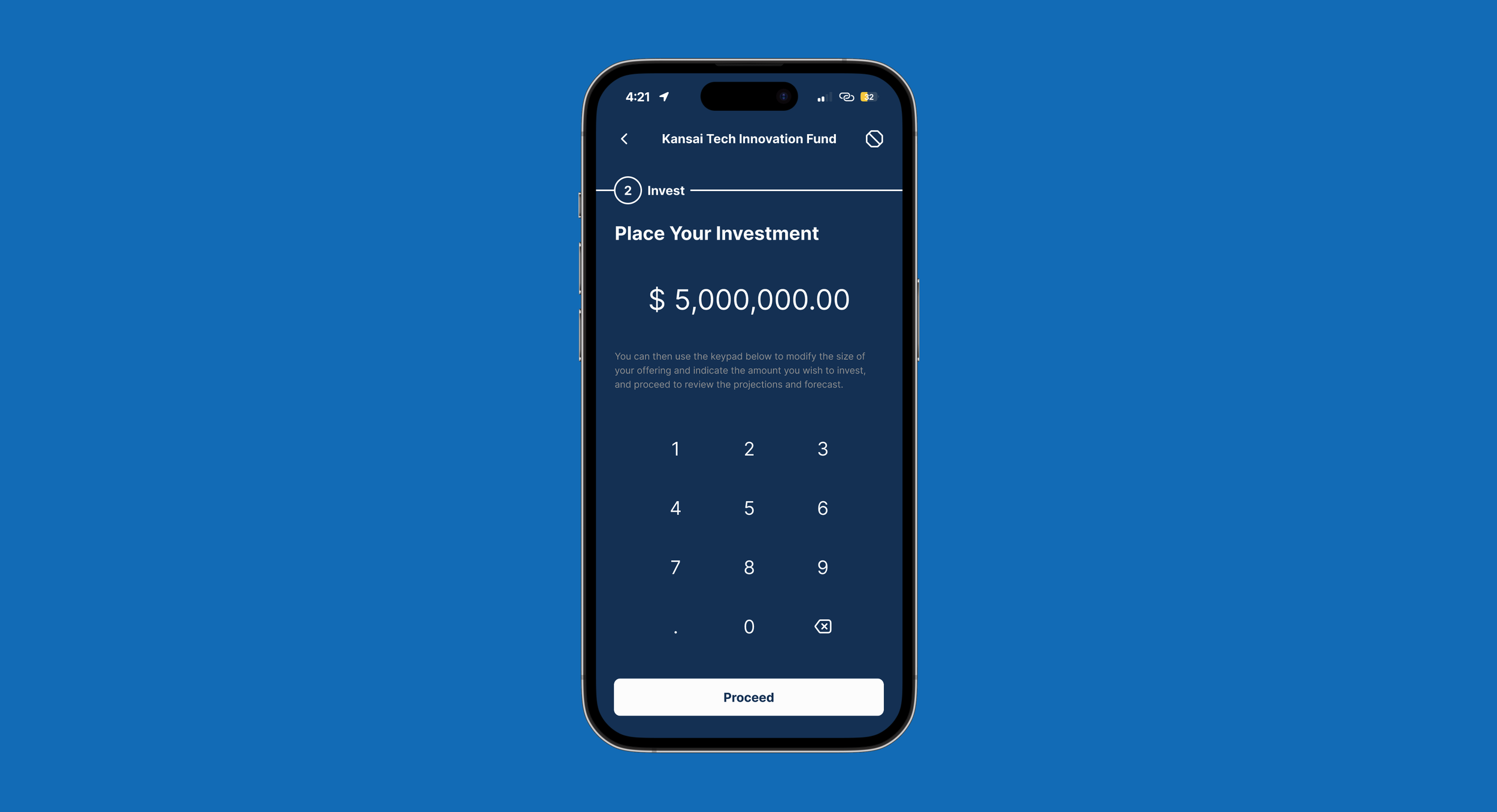

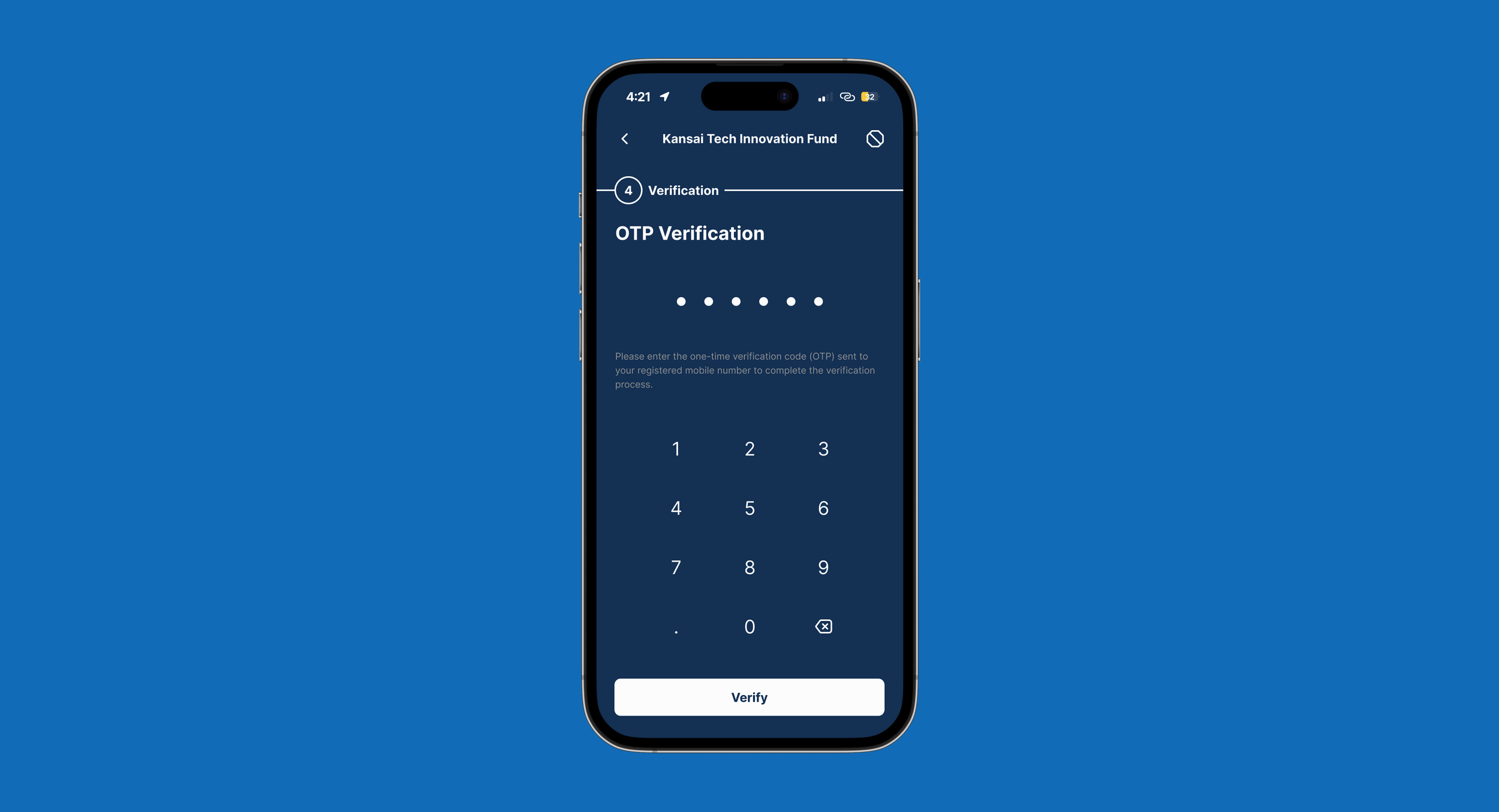

The Final Prototype

Learning Journey

Investing Journey

Screens

07

The Journey Forward

Operational Requirements

Preparing for the successful adoption of this prototype involves considering several operational requirements beyond technical and development aspects. These requirements are essential to ensure that Investcorp can effectively cater to its audience:

Offering educational courses necessitates the development and maintenance of high-quality, up-to-date educational content. This involves collaboration with subject matter experts, instructional designers, and content creators to ensure the courses remain relevant, informative, and engaging for users seeking to enhance their investment knowledge.

Educational Course Development

Implementing the new prototype requires a robust content strategy to curate and deliver relevant news, videos, and podcast content to the target audience effectively. This involves content creation, scheduling, and maintaining a consistent flow of updates that align with the users' interests and needs.

Content Strategy and Management

Developing a comprehensive marketing and outreach strategy to attract more Millennial and Gen Z clients to experience Investcorp’s digital offerings.

Marketing and Advertising

Next Steps

Our journey continues with a focus on enhancing the user experience. Here are the next steps and opportunities for development on our path forward:

Going Tablet

Creating a tablet version of the prototype for an enhanced learning experience.

Web Portal Redesign

Improving Investcorp’s website portal to enhance accessibility and functionality.

Implementing user analytics tools to gain deeper insights into user behaviors, preferences, and provide the user with necessary knowledge and progress metrics.

Interfacing Analytics

Continuously gathering user feedback to refine and evolve Investcorp’s digital offerings.

Further Research

08

Lessons Learned

Reflections

Throughout this project, I've gained valuable insights and experiences as a UX/UI designer. These lessons have not only shaped the success of our work but have also enriched my approach to user-centered design.

Thorough Research Pays Off

In-depth research on the company and conducting a comprehensive competitive analysis helped us understand the industry and its best practices. User interviews uncovered critical pain points that informed our design choices and better-prioritized user needs and preferences to guide effective design choices.

Iterative Design Drives Excellence

Usability and A/B Tests identified critical issues that helped us optimize our design, this iteration allowed us to fine-tune and enhance the experience which eventually led to more user-friendly solutions.

Holistic Understanding of User Personas

Beyond their needs as users, understanding the broader context of users' lives aids in designing more empathetic solutions. Knowing their aspirations, challenges, and lifestyles enriches the design process.

Conclusion

In the dynamic landscape of digital finance and investment, our journey with Investcorp project to introduce wealth management to a new generation of investors has been both enlightening and rewarding. Through a user-centric approach, meticulous research, and iterative design, we've embarked on a transformational path to enhance the Investcorp Wealth Mobile App.

We've learned that bridging generational gaps in investment engagement requires more than just innovation; it necessitates understanding, empathy, and adaptability. These were the driving forces behind our commitment to delivering a platform that empowers, educates, and engages.

Our lessons learned underscore the pivotal role of user-centricity, iterative design, and usability testing in achieving an exceptional user experience. It is through these principles that we have reimagined the Investcorp Wealth Mobile App as a gateway to financial knowledge, sustainability, and growth.

As we embrace the journey forward, we're excited about the possibilities that lie ahead, and our commitment remains steadfast, and our aspiration is clear: To redefine wealth management for a new generation and inspire a future of prosperous and purpose-driven investments.

Thank you for joining us on this transformative journey.

09

Acknowledgements

Gratitude

I would like to express a heartfelt gratitude to General Assembly for entrusting me with the invaluable journey of the User Experience Design Immersive course. My sincere appreciation extends to our dedicated instructors and assistants: Siddhartha Phillips, Osai Hashimi, Abrar Abdulwahab, and Hina Khalil. Your unwavering support, guidance, and encouragement have been instrumental in the project's success.

I would also like to extend our profound thanks to my teammates, Faten Zainal and Ayesha Rasheed, whose collaboration was pivotal to the success of this endeavor. Additionally, my thanks go out to the numerous participants who generously contributed their time and insights in our user interviews and usability testing sessions.

Your collective efforts have been invaluable in shaping the outcome of this project, and I am immensely grateful for your involvement and dedication.